Woodwell and partners weigh in on climate risk disclosure

In March, the SEC issued a request for public input on potential regulation of corporate climate risk disclosure. In the intervening months, Woodwell staff have been working alongside our partners to share the insights we have gained from years of working on corporate climate risk, and to ensure that federal regulators and policymakers understand the importance of ensuring scientific integrity in such disclosures. The results of that work have been made public over the past week.

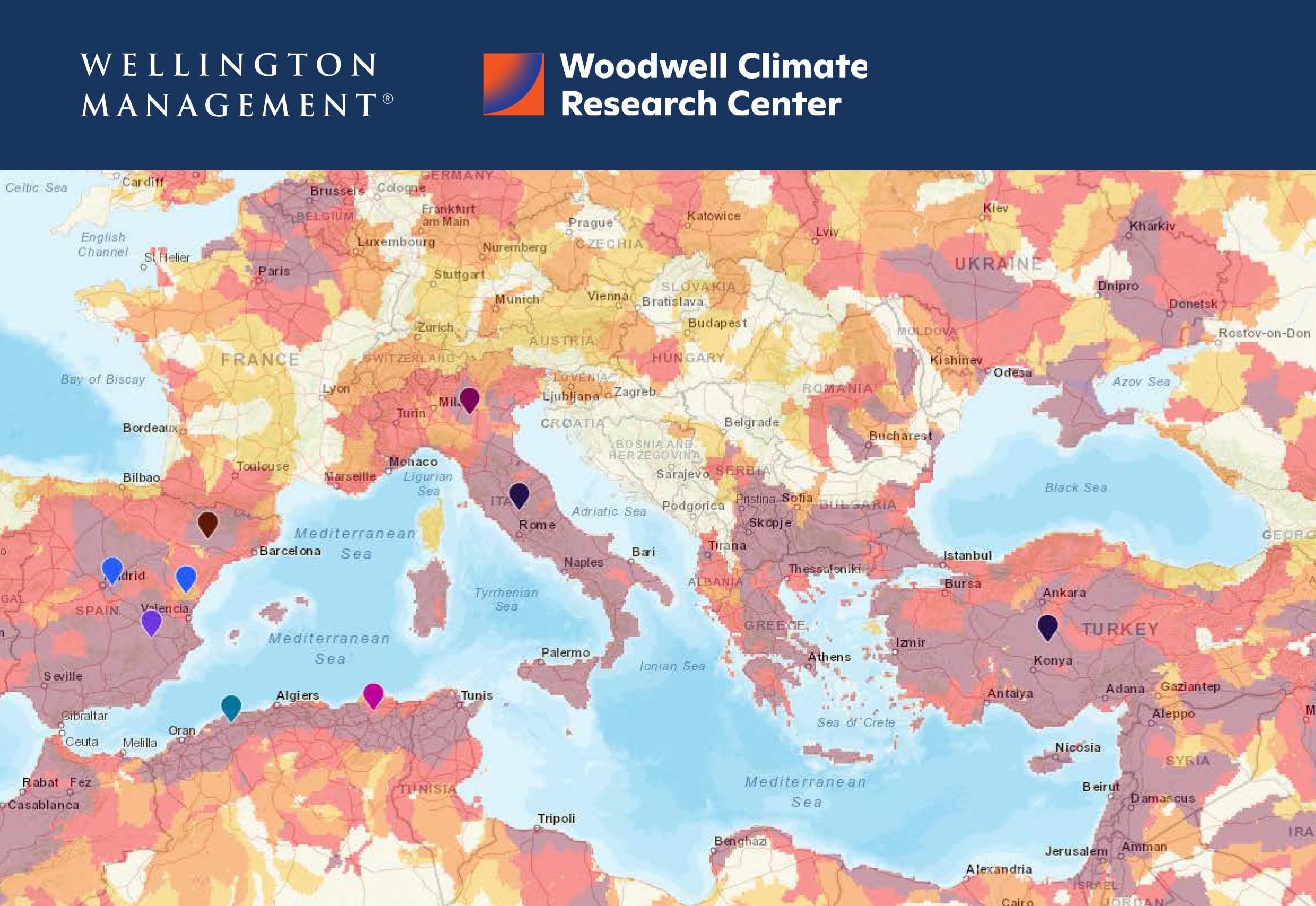

Above: Map generated from Wellington’s Climate Exposure Risk Application (CERA)

On June 10, 2021, Woodwell Climate and Wellington Management jointly launched P-ROCC 2.0, an update to our 2019 guidelines for corporate climate risk disclosure that recommends the disclosure of time horizon and key assumptions (including climate data) used in assessing risks, as well as the physical attributes of the company’s business.

“As we continue to expand our climate research, it is becoming increasingly clear that our investors and clients will benefit from deeper climate-related information at the company level,” said Jean Hynes, incoming CEO of Wellington. “We encourage companies to facilitate access to their physical location data as this is a critical component that will help us incorporate deeper physical and transition risk climate analysis on behalf of our clients.”

Both Woodwell and Wellington also submitted public comments to the SEC emphasizing the need for federal regulators to create a framework that ensures corporate climate risk assessments are rigorous, standardized, and transparent.

An array of parties offered input—investment firms, energy companies, green groups and plenty in between. But one stood out from the crowd: the Woodwell Climate Research Center.Andrew Freedman, Axios

In particular, Woodwell’s comments called for requiring that data and methodologies be publicly accessible and that climate models be published in mainstream peer-reviewed scientific literature.

“As a climate science organization, we see a clear need for a standardized and transparent climate risk disclosure framework,” wrote Dave McGlinchey, Woodwell’s Chief of External Affairs. “A rigorous and properly constructed framework can provide investors with key material information necessary to evaluate their investments.”

This message was echoed in a public briefing co-hosted by Niskanen Center and Woodwell Climate, a story in Axios, and finally, in an op-ed in The Hill authored by Woodwell President Dr. Phil Duffy, Woodwell Board member Bob Litterman, and Niskanen Director of Climate Policy Joseph Majkut.

“It is critical that risk disclosure be based upon transparent and publicly accessible models and data. Without this requirement, disclosures may be inaccurate, misleading, or impossible to interpret and compare between firms,” the three warned.